At Canopy, we believe the best way to build wealth over the long term is by investing in high-quality companies that we know intimately. This approach is supported by decades of empirical evidence and the experience of many of the world’s most successful investors.

Quality companies share distinctive characteristics. They generate strong returns on capital and can reinvest at high rates for extended periods, producing earnings growth that drives stock price performance. They are led by capable, aligned management teams who can navigate through changing circumstances, and typically exhibit more stable business performance, enabling investors to build and maintain conviction through periods of volatility.

Many people, however, begin their investment journey seeking quick profits. They might hunt for bargains with apparent near-term catalysts or chase momentum into ‘The Next Big Thing’. These approaches rarely succeed over the long term – companies are typically cheap for fundamental reasons, momentum inevitably fades, and without a deep understanding of the underlying business, investor conviction often proves fragile when challenges arise.

Quality investing requires patience and discipline. Outsized gains typically don’t materialise in days or months, but through years of steady compounding. This approach may seem less exciting than hunting for the next big winner or deep value opportunity, but it has consistently proven to be one of the most reliable paths to long-term wealth creation.

Historical outperformance of quality companies

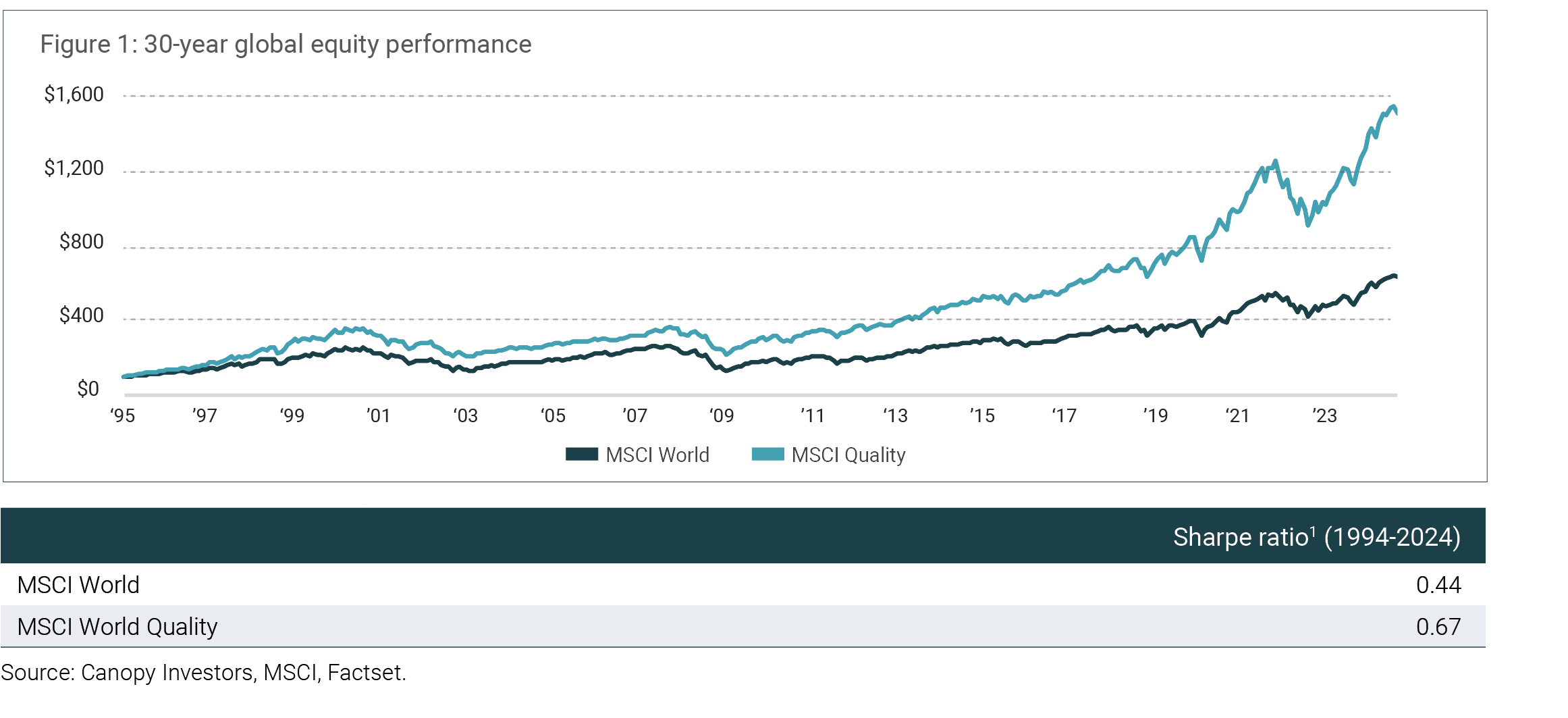

The historical evidence for quality investing is compelling. The MSCI World Quality Index – which selects companies based on high profitability, low profit variability, and low leverage – has delivered 9.6% p.a. returns compared to 6.5% p.a. for the broader MSCI World Index over the past 30 years. This 3.1% annual difference compounds dramatically – a $10,000 investment in the quality index in November 1994 would have grown to approximately $157,000 by today, compared to $67,000 in the broader index.

There are a few other notable features of the quality factor:

Quality is global

Research by Asness et al. (2019) shows that high quality stocks (defined by high profitability, profit growth, business stability, and conservative leverage) have outperformed across 24 countries, suggesting that the relationship between business quality and returns is fundamental rather than market specific.

A quality focus improves returns when investing in smaller companies

Asness et al. (2018) found that the observed return premium generated by smaller companies is enhanced by limiting portfolios to high quality companies. Small-cap indices have seen a growing concentration of lower quality companies over time, making active quality selection increasingly important.

Valuation discipline enhances quality returns

Quality investing becomes even more powerful when combined with valuation discipline. Research by Novy-Marx (2013) found the outperformance of quality stocks (defined by gross profitability) is further enhanced by adjusting quality holdings to maximise value (as defined by the book-to-market ratio). Meanwhile, Kozlov & Petajisto (2018) showed that the superior returns of companies with high earnings quality are boosted by adding a “value tilt”. Finally, Greenblatt’s (2005) ‘magic formula’ portfolios, which combine quality (i.e. return on capital) with value (i.e. earnings yield), were shown to consistently beat the market over historical rolling 10-year periods.

Why does the quality anomaly persist?

Many market anomalies disappear once discovered, as investors quickly exploit them until the excess returns vanish. The quality premium, however, has proven remarkably durable. We see two main reasons for this persistence:

1. Short-term performance pressures

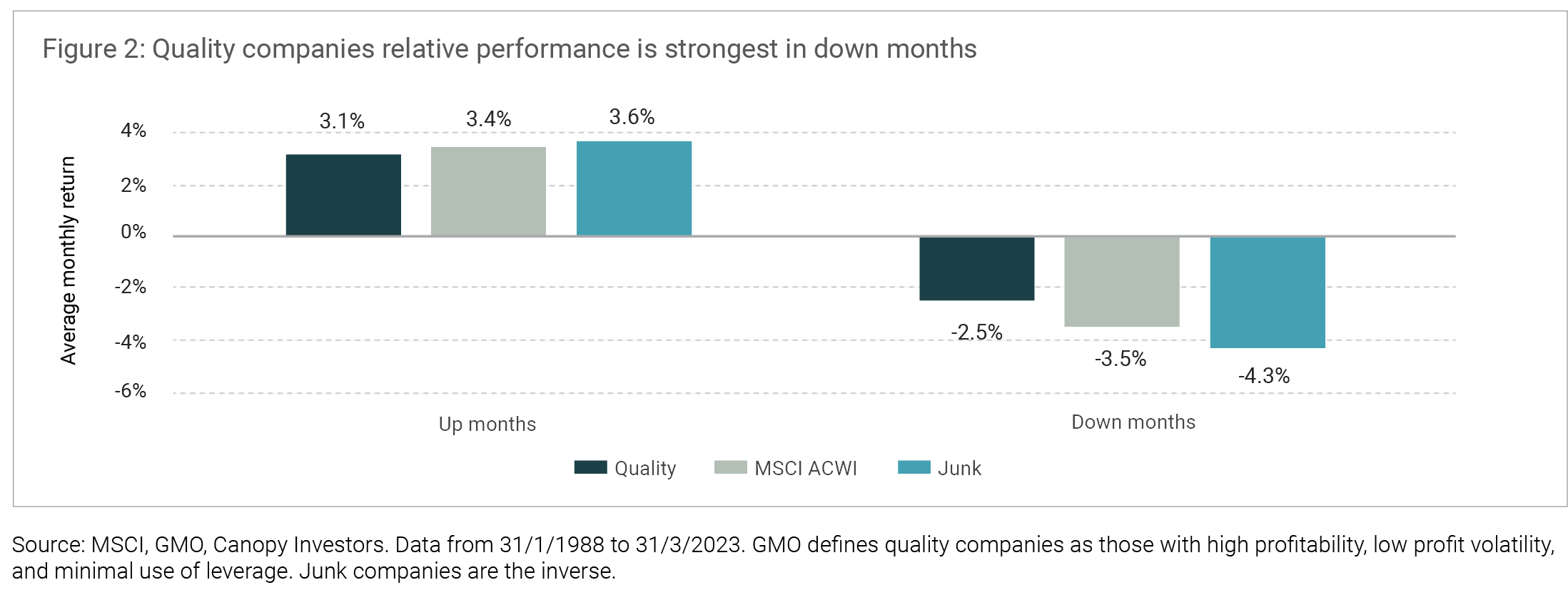

Quality investing often tests investor patience, particularly during bull markets. As shown in the chart below, high quality companies typically modestly lag low quality stocks during market upswings, though they materially outperform in downturns. This pattern creates a challenging dynamic, since both individual and professional investors face constant pressure to deliver short-term results. These institutional constraints and behavioural biases lead many investors to abandon quality investing precisely when patience would be most rewarded.

2. Subjectivity complicates replication

Quality resists straightforward quantification. While academic studies rely on various metrics to measure quality – from profitability to leverage ratios – no single definition captures all relevant aspects and almost all are backwards looking. Many crucial elements, such as management capability or changing competitive positioning, require insight and subjective judgment. This complexity makes it difficult to systematically replicate quality investing through algorithms or rigid frameworks, helping preserve the opportunity for disciplined investors.

Our approach

At Canopy, we have developed a clear framework for identifying truly high-quality companies, focusing on four essential characteristics:

- Sustainable competitive advantages such as scale, business process, customer loyalty, and network effects. These advantages allow a business to generate superior returns on capital and capture at least its share of industry growth.

- Operation in secularly growing industries with a low chance of being disrupted.

- Competent and aligned management who can navigate the business through an uncertain future, leaning into strengths and capitalising on inevitable changes in circumstances.

- Effective management of environmental, social, and governance (ESG) risks that pose long-term challenges to their business.

We are convinced there is no substitute for quality. By focusing on exceptional businesses rather than market timing or price momentum, we align ourselves with the world’s best investors in pursuing sustainable wealth creation.

The content contained in this article represents the opinions of the authors. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.

Asness, C. S., Frazzini, A., Israel, R., & Moskowitz, T. J. (2018). Size Matters, If You Control Your Junk. Journal of Portfolio Management, 44(3), 87-103

Asness, C. S., Frazzini, A., Israel, R., & Moskowitz, T. J. (2019). Quality Minus Junk. Journal of Financial Economics, 122(2), 1-25.

Inker, B. (2023). The quality anomaly. GMO Quarterly Letter, Fourth Quarter 2023.

Greenblatt, J. (2005). The Little Book That Beats the Market. John Wiley & Sons.

Kozlov, M., & Petajisto, A. (2018). Global Return Premiums on Earnings Quality, Value, and Size. The Journal of Portfolio Management, 44(3), 104-118.

Novy-Marx, R. (2013). The Other Side of Value: The Gross Profitability Premium. Journal of Financial Economics, 108(1), 1-28.