Long-term investment success requires differentiated thinking supported by genuine conviction. At Canopy, we believe conviction cannot be borrowed or assumed; it must be built through detailed research and a deep understanding of the businesses we invest in. When markets turn volatile and uncertainty reigns, the strength of our conviction can be the difference between seizing opportunity and capitulating at precisely the wrong moment.

The challenge of maintaining conviction

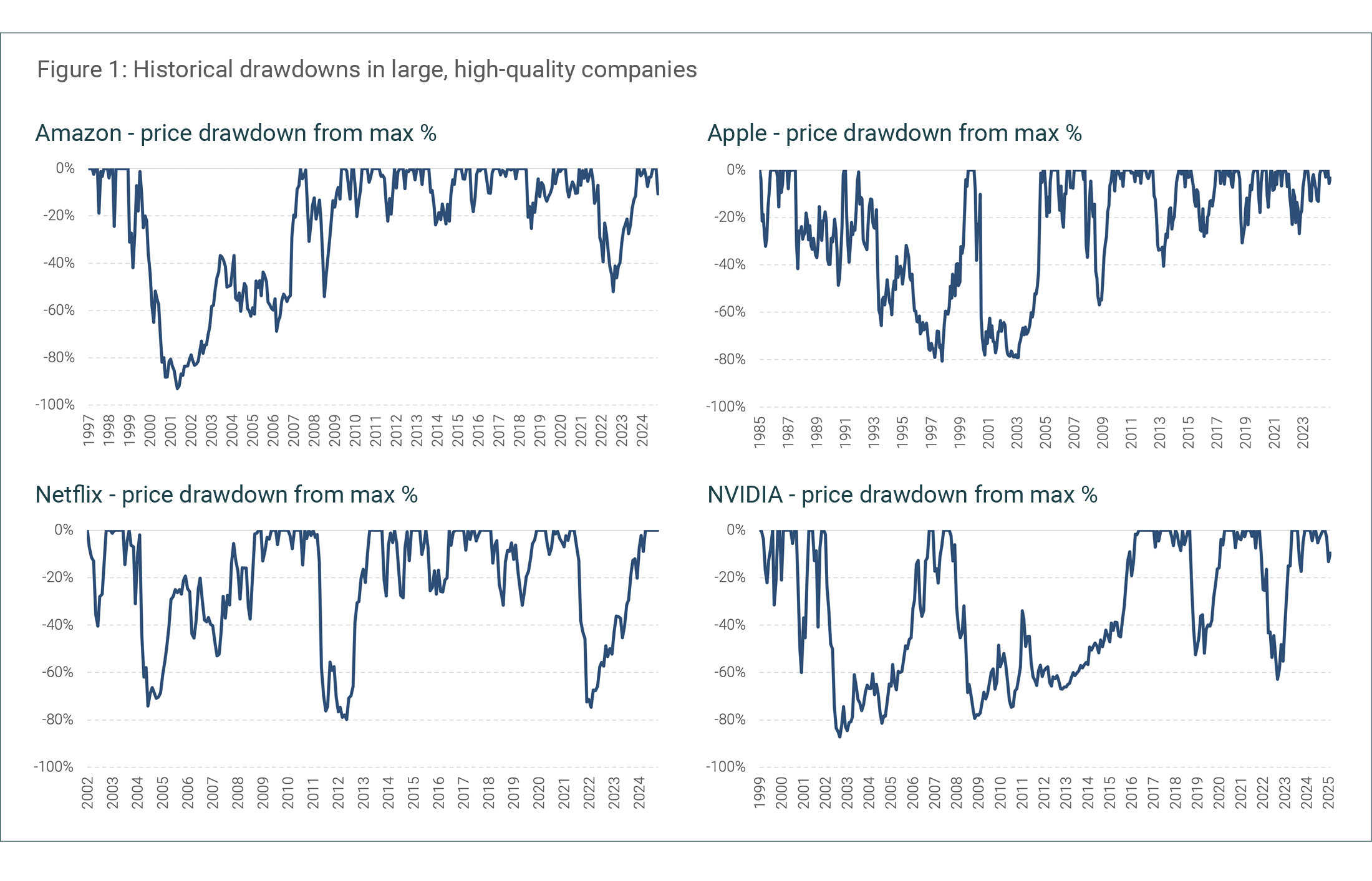

Maintaining conviction through market volatility is one of the toughest challenges investors inevitably face. As shown in the charts below, even the largest and highest quality companies can experience significant price declines that test investor resolve. Amazon’s share price fell 93% between December 1999 and September 2001, took eight years to regain its prior high, and then dropped more than 50% again during the Global Financial Crisis. Similarly, Apple, Netflix and NVIDIA have each weathered multiple declines exceeding 70% on their paths to becoming some of the world's most valuable companies.

Source: FactSet, Canopy Investors.

Source: FactSet, Canopy Investors.

This pattern isn't limited to a few notable exceptions. In a study of the top 100 most successful companies of each decade since 1950, Bessembinder (2020) found that even these exceptional investments experienced average drawdowns of 32.5%, lasting 10 months.

Volatility has real consequences for realized investment returns. A long-running analysis by market research firm DALBAR (2022) found that, over the last three decades, the average US equity fund investor has underperformed the S&P 500 by 3-4% annually - primarily because of buying high and selling low during volatile periods. When share prices decline and negative sentiment builds, many investors abandon sound investments precisely when they should maintain or increase their positions. As Cullen Roche put it, “The stock market is the only store where, when everything is on sale, people run away.”

At the root of this behaviour is what we call ’borrowed conviction’ – investment theses adopted from respected investors, the financial media or popular sentiment rather than developed through independent research. When negative headlines accumulate and prices fall, borrowed conviction can crumble in the face of mounting pressure to sell. Only by developing one’s own conviction – built on a deep understanding of a business, its competitive advantages, its long-term prospects and cash flow generation – can investors maintain confidence in the face of market pessimism or temporary setbacks.

Being different and right

"To achieve superior investment results, you have to hold views that are different from the consensus and be right." - Howard Marks. Being different alone is not sufficient; contrarianism without insight typically leads to poor results.

Detailed research reveals opportunities where the market's understanding is incomplete or incorrect. These opportunities often arise in several ways:

- Misjudged growth runways: The market frequently underestimates how long high-quality companies can sustain growth.

- Overreaction to temporary setbacks: Markets often overreact to short-term challenges that don't impair long-term business value. Thorough research can often distinguish between genuine competitive threats and transitory issues.

- Misunderstood business models: Complex or evolving business models are frequently misvalued.

- Overlooked structural advantages: Some companies possess durable competitive advantages that are not immediately apparent from financial statements or superficial analysis.

Strong conviction must be balanced with intellectual flexibility. As Charlie Munger observed, “Part of what you must learn is how to handle mistakes and new facts that change the odds.” This balance helps distinguish between appropriate persistence and mere stubbornness - knowing when to hold firm in your thesis and when to adapt to new evidence.

Our approach

At Canopy, we have developed a structured research process designed to build knowledge, test assumptions and size positions based on conviction levels:

- Comprehensive business analysis: We analyse competitive dynamics, industry structure, management capability and disruption risks through extensive primary research, including interviews with management teams, customers, competitors and industry experts. The resulting quality and valuation assessment forms the foundation of our conviction.

- Thesis articulation and testing: For each investment we develop a clearly articulated investment thesis that identifies the key drivers of future value creation, recorded in a central database. These are continuously tested against new information, allowing us to distinguish between normal business volatility and genuine challenges to our core assumptions.

- Team collaboration: Our flat team structure ensures multiple perspectives on each investment, with every position covered by both primary and secondary analysts. This collaborative approach creates natural checks and balances, strengthening conviction by subjecting ideas to rigorous debate and diverse viewpoints.

- Conviction-based decision making: Our research directly informs position sizing, which evolves as our understanding deepens or circumstances change. This framework helps maintain conviction through periods of underperformance while ensuring we remain responsive to invalidating evidence.

Investing with conviction

We believe conviction built on detailed research is essential for long-term investment success. Our structured research process develops this conviction through comprehensive business analysis, clear investment theses, collaborative team input and systematic position sizing. This disciplined approach enables us to identify opportunities amid volatility and maintain positions when others capitulate.

Bibliography

Bessembinder, Hendrik. (2020). ‘Extreme Stock Market Performers, Part I: Expect Some Drawdowns’. Available at SRN: https://ssrn.com/abstract=3657604

DALBAR, Inc. (2024). ‘Quantitative Analysis of Investor Behavior 2024’.

Lynch, Peter, and John Rothchild. (1989). "One Up on Wall Street: How to Use What You Already Know to Make Money in the Market". Simon & Schuster.

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. The commentary in this article in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.